Various reports and the number of Blockchain use cases implemented suggest that the financial sector stands to gain the most from Blockchain-based service implementations. Some of the many use cases discussed below are to highlight only the most obvious use cases.

Trade Finance

In trade finance Stock and Share sale and purchase transactions that can sometimes take two to three day are made through brokers and exchanges for clearing and settlement it requires tedious processing through paper and electronic media. Each party including middlemen maintain their record of transactions or ledger on paper or in databases and their balances should accurately match. An error can easily propagate and difficult to fix in time to avoid losses. Use for Blockchain can enhance accuracy and speed of transaction processing, verification and reduce risks of unintentional errors and fraud. Other benefits include Blockchain-based trust and transparency to monitor and verify transactions from start to finish.

According to the Fintechnews (Anon, 2018), “Financial institutions such as HSBC, Standard Chartered, Societe Generale, Deutsche Bank, UBS, and even China’s central bank, among many others, are all looking to leverage Blockchain to streamline international trade transactions and reduce risk in the US$16 trillion in global trade done annually”.

Cross border trading – Letter of Credit (LC) and Payments

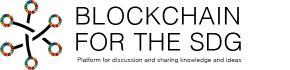

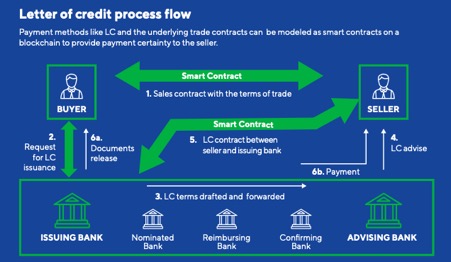

A Cognizant study Varghese et al. (n.d.) indicate that between 60% and 70% of documents presented for LC evaluation are rejected on the first presentation due to such discrepancies. According to a World Trade Organisation report (Emanulelle Ganne, 2018). Varghese et al. (n.d.) reported that “given the possibilities for terminology-related and typographical mistakes and oversights by various parties, mismatches can easily occur in LC and trade documents. The Blockchain technology is seen as a possible game-changer to digitalize and automate trade finance processes, in particular, letters of credit, to ease supply chain finance. As mentioned in a report from Cognizant (Varghese et al., n.d.), payments can be modelled as self-executing contracts on Blockchain and parties across the trade finance continuum could automate contract compliance to ensure faster-assured payments as well prevent disputes that arise from ambiguities in payment contract terms and conditions.

Letter of Credit process flow. Source: Cognizant.com

Varghese et al.(n.d.) further explain their paper related to payment methods automation that, “using Blockchain, an LC can be modelled as a smart contract between the financier and the supplier to guarantee payment to the latter — if the trade merchandise is delivered to the buyer in accordance with all specified conditions. A Blockchain smart contract codifies the terms and conditions of trade. This is done by abstracting and expressing conditional clauses — regarding the time, place and manner of shipment and delivery, the description and quantity of the goods shipped and the documentary evidence required for verification — as separate, independent or interdependent functions that provide pass/fail outputs based on the input information”.

Blockchain Smart Contracts to reduce ambiguities and errors – Source: Cognizant.com

Micro Finance

According to the SDGs, financial inclusion has a direct impact on the success of other SDGs such as health, education, and gender equality, growth, as well as inequality and peace. Microfinance initially started from donor individuals and organisations through public or non-profit agencies and profitability, which is important for the sustainability of a business model was not a priority. With the success of Microfinance, commercial Microfinance institutions (MFIs) have also moved in this financial sector. Sustainability of this important financial section requires profitability and consistency with its initial mission of inclusion of the poor and low-income clients’ population that is unbanked and has limited or no access to other credit schemes. However, according to 2018 Microfinance Barometer report (Convergences.org, 2018) MFI’s generated losses in the past due to reasons such as high costs of operations, repayment delays, portfolio quality problems or other reasons.

Blockchain can prove to be very useful for MFI’s as well as to billions of people belonging to the global group of poor and low-income clients’ population by first connecting people directly to each other without middlemen leading to rethinking some of the microfinance models. Blockchain can also help in recording, verification of credit histories, ID verification, disbursements and collection as Data sharing and protection (Adebaki, 2019).

As mentioned by Convergences.org (2018) in their Microfinance Barometer report “Blockchain-enabled transactions for financial inclusion have attracted enormous attention by promising features such as payments tracking, low-cost secure ledgers maintaining an account holder’s transactional history and trustless systems where third-party intermediaries are no longer required. The ledger also serves as a credit reporting mechanism, but even more importantly, the system does not only connect borrowers to lenders but in fact connects all borrowers and all lenders on the same network” (Adebaki, 2019).

Several use cases are being implemented in this sector.

- Tech Bureau Corporation an Osaka-based company and Infoteria Corporation, the Tokyo-based firm has announced the good news that the first Blockchain microfinance service was being successfully demonstrated by the two businesses. The verification of the operation of the Blockchain Mijin was made to apply on Microsoft Azure using ASTERIA WARP (Schweiz, 2016).

- The first experimental demonstrations of a private Blockchain in microfinance account data recording was in 2016. It is notable that initial experiments were developed in areas with high demand for microfinance services and for easier access to banking services such as Myanmar and Somalia, and that some of the fastest scaling projects, such as BitPesa, are from emerging countries (Convergences.org, 2018).

- Assetstream aims to reduce poverty and bring financial inclusion by providing unbanked people with access to financial services plans to expand to a full peer-to-peer network, which will include the local communities that can take personal loans. According to their white paper “the AssetStream initiative was established to create a sustainable microfinance platform to enable growth and advocate poverty reduction of the unbanked population while providing an alternative, high-yield, peer-to-peer microfinance platform for everyone”(The AssetStream, n.d.).

Mutual Funds

A mutual fund is both an investment and an actual company made of a pool of money collected from many investors to invest in securities such as stocks, bonds, money market instruments, and other assets (Hayes, 2019). A fund manager allocates the fund’s assets to produce capital gains or income for the fund’s investors who become shareholders of the fund. Income or capital gains on the investment is paid to the fund owners. (Hayes, 2019) explains that “if the fund sells securities that have increased in price, the fund has a capital gain. Most funds also pass on these gains to investors in a distribution”.

According to Sharma (2019), the mutual fund industry’s biggest challenge is its centralized environment that requires incurring high costs of maintaining digital infrastructure. Moreover, the current administration of mutual funds relies on numerous third parties and processes such as banks or other financial institutions that sign up new investors and keep a record of their accounts. Altogether, the transaction times for subscriptions, payments and settlements are lengthy. Mutual fund sector can use Blockchain to eliminate the intermediate steps for customer onboarding, reporting, portfolio management, trading and settlement. The features of Blockchain such as accountability, transparency, decentralization, privacy, and tamper-resistance will help stakeholders save both cost and time. As Sharma (2019) explains, “Transaction processing can be automated using Smart Contracts thereby ensuring that updated information is available on the Blockchain at all times. Blockchain is a boon for the asset management industry as it assists in the investment decision-making process, protects portfolios from risk, and is vital for wealth generation”.

One example is Calastone solutions (Calastone, 2019) using Blockchain to fully digitalise the global order routing, settlement and registry updates for mutual funds via the Distributed Market Infrastructure. Their solution “enables all market participants to benefit through the real-time view of each fund transaction, and agree on the data and the outcome, ensuring there is a single, accurate version of all trades and balances. The Blockchain data structure of storing data into blocks allows managers to differentiate each transaction, through individual tranches. This is not possible with the current data recording methods of lumping each investment into one transaction. Unlike traditional investment methods, Blockchain-based system also supports a quick view of granular data and thus calculations of income and its distribution, which helps in cutting costs.

Chit Fund – old and classic peer to peer system

Chit means a transaction and Chit fund, Chitty or Kuri mechanism of funding where a person enters into an agreement along with a specified number of people such that all of them shall subscribe to a certain amount of money or gain (Sharma, 2018). Through a claiming, lucky draws or an auction process an amount of money is drawn and paid to a subscriber who must repay the money gained in periodical instalments over a time period. Chit funds provide easier access to credit and such schemes are conducted by registered financial institutions as well as unorganized schemes run by relatives or friends. In most cases record-keeping is manual and chit fund subscribers can be in several hundred or thousands. There have been several scams and it is challenging to maintain trusted records. Chitmonks, (n.d.) is offering a solution based on Blockchain technology with the aim of “bringing trust among subscribers and ensure that there is no manipulation of numbers”.

Insurance

Blockchain technology has the potential to make a disruptive impact on the insurance industry. According to a recent study by (Cognizant, n.d.), 86% of leaders in the insurance industry believe this technology will be essential or very important in the future. According to Accenture (Jim Bramlet, 2018), “within insurance, the claims and finance functions are high-value areas where Blockchain could be beneficial, especially when you look at processes that need ongoing reconciliation with external parties”. Accenture also states that almost 50% of insurers will be using Blockchain within the next two years. 84% of respondents even think Blockchain and Smart Contracts will completely redefine the interaction with partners. Blockchain-based Smart Contracts can produce a more transparent and secure arrangement between insurers and customers.

The insurance industry, besides finance, is one of the business areas that has seen the most interest and use cases implemented using Blockchain. New business models such as peer-to-peer insurance, disintermediation, Smart adjusting policies, self-insurance, Smart-device insurance add-ons are some quoted by experts (Jim Bramlet, 2018). Many examples of use cases implemented for the insurance industry or being can be found online. Some of them are listed below. (International Business Times, 2017)

- Allianz Global Corporate & Specialty (AGCS) prototyped a Blockchain-powered captive insurance platform with accelerated workflows for faster and more secure policy and claims management.

- Prudential Singapore (Prudential) and StarHub launched a Blockchain-based digital trade platform called Fasttrack Trade (FTT) for small and medium-sized enterprises (SME). It will allow SMEs to find business distributors, buy and sell goods, track shipments, receive and make payments, and access finance products on a single platform (Singapore Business Review, 2017).

- Stratumn (2018) provides solutions for insurance Claim Automation and to securely store customer data and comply with new EU regulations on customer mobility.

- The Institutes, (2019), RiskStream Collaborative™ is an industry-led consortium collaborating through various partnerships within the RiskStream Collaborative consortium to use the Blockchain to address use cases across the insurance industry, such as proof-of-insurance verification, first notice of loss data sharing, and parametric insurance. An associated working group of individuals from various member companies work on each use case. Consortium members prioritize and determine which Blockchain use cases to pursue based on strategic analysis and member agreement.

- Tokio Marine, NTT DATA successfully test Blockchain-based cargo insurance certificates. This was reported to have “dramatically reduced the shipper’s data inputting workload, compared to the current web-based insurance certificate issuing system. “It was actually proven that the Blockchain-based system will cut 85% of the shipper’s time of data inputting work in order to receive an insurance certificate. It was also tested in terms of accessibility from the parties concerned, such as consignee and banks,” said Tokio Marine in a statement (International Business Times, 2017)

References:

- Adebaki, B. (2019) ‘Microfinance and alternative data meets the world of Blockchain’, Medium [Online]. Available at https://medium.com/blockchain-at-berkeley/microfinance-and-alternative-data-meets-the-world-of-blockchain-9aa7f8e39239 (Accessed 30 June 2019).

- Anon (2018) ‘Banks Ramp up Blockchain Trade Finance Race’, Fintech Schweiz Digital Finance News – FintechNewsCH [Online]. Available at http://fintechnews.ch/blockchain_bitcoin/banks-ramp-up-blockchain-trade-finance-race/23549/ (Accessed 3 July 2019).

- Calastone (2019) ‘Solutions – Calastone’, Solutions – From funds automation to distribution insights, drive efficiency across your business [Online]. Available at https://www.calastone.com/solutions/ (Accessed 28 June 2019).

- Chitmonks (n.d.) ChitMonks | Your Smart Chit Manager [Online]. Available at https://www.chitmonks.com/ (Accessed 28 June 2019).

- Cognizant (n.d.) Blockchain Primary Research — Adoption Study [Online]. Available at https://www.cognizant.com/blockchain-adoption-primary-research (Accessed 30 June 2019).

- Convergences.org (2018) MICROFINANCE BAROMETER 2018 [Online]. Available at http://www.convergences.org/wp-content/uploads/2018/09/BMF_2018_EN_VFINALE.pdf (Accessed 30 June 2019).

- Emanulelle Ganne (2018) Can Blockchain revolutionalize international trade, World Trade Organisation [Online]. Available at https://www.wto.org/english/res_e/booksp_e/blockchainrev18_e.pdf.

- Hayes, A. (2019) Mutual Fund Definition [Online]. Available at https://www.investopedia.com/terms/m/mutualfund.asp (Accessed 28 June 2019).

- International Business Times (2017) Tokio Marine and NTT DATA complete blockchain-based cargo insurance certificates [Online]. Available at https://www.ibtimes.co.uk/tokio-marine-ntt-data-complete-blockchain-based-cargo-insurance-certificates-1618300 (Accessed 30 June 2019).

- Jim Bramlet (2018) Ultimate Guide to Blockchain in Insurance – Accenture Insurance Blog [Online]. Available at https://insuranceblog.accenture.com/ultimate-guide-to-blockchain-in-insurance (Accessed 30 June 2019).

- Schweiz, Ü. den A. B. N. (2016) ‘The First Blockchain Microfinance Service is implemented by Japanese Tech Firms’, Bitcoin News Schweiz [Online]. Available at https://www.bitcoinnews.ch/4237/microfinance/ (Accessed 30 June 2019).

- Sharma, T. K. (2019) ‘How Blockchain Can Prove To Be A Boon For India’s Mutual Fund Industry’, [Online]. Available at https://www.blockchain-council.org/blockchain/how-blockchain-can-prove-to-be-a-boon-for-indias-mutual-fund-industry/ (Accessed 25 June 2019).

- Sharma, V. (2018) What is the difference between a chit fund and a mutual fund? [Online]. Available at https://medium.com/@vikrant.sharma/what-is-the-difference-between-a-chit-fund-and-a-mutual-fund-4cd07c1fa2a3 (Accessed 12 July 2019).

- Singapore Business Review (2017) Prudential, StarHub launch blockchain-based digital trade platform [Online]. Available at https://sbr.com.sg/financial-services/news/prudential-starhub-launch-blockchain-based-digital-trade-platform (Accessed 30 June 2019).

- Stratumn (2018) STRATUMN | Insurance Claim Automation Across Europe [Online]. Available at https://stratumn.com/business-case/insurance-claim-automation-across-europe/ (Accessed 30 June 2019).

- The AssetStream (n.d.) The AssetStream, Your Choice for the Future [Online]. Available at https://www.assetstream.co (Accessed 30 June 2019).

- The Institutes (2019) RiskStream Collaborative | The Institutes [Online]. Available at https://www.theinstitutes.org/guide/riskstream-collaborative (Accessed 30 June 2019).

- Varghese, L., Goyal, R. and Solutions, C. T. (n.d.) ‘Blockchain for Trade Finance: Payment Method Automation (Part 2)’, p. 16.

Unlocking Economic Advantage with Blockchain – A guide for asset managers

Also read:

Blockchain & DLT in Trade – A Reality Check